Thursday, October 30, 2008

Barack TV

Godless money

Seed Magazine endorsed Obama. No surprise there.

A new article in Newsweek discusses belief in the paranormal and supernatural as a coping mechanism.

Hitchens debated the guy who wrote, "I Don't Have Enough Faith to be an Atheist".

Wednesday, October 29, 2008

McCain further discredited

Today a new story surfaces showing the same influence peddling as the NYT reported about Vicki Iseman...only about a Keating associate in a land swap deal.

Saturday, October 25, 2008

NYT Magazine article on the McCain campaign

Thursday, October 23, 2008

Religiosity redux

We are an outlier:

(from Pew Report's "Global Attitudes Project", published 9/17/08)

In the above graph, national religiosity is plotted against wealth. The inverse correlation between religiosity and prosperity among various countries is interesting and does exist. The US is a notable outlier, though. You could argue that economic freedom and religious freedom usually both produce more prosperity and more religiosity, but besides here in the US, that doesn't seem to hold true.

A GLOBAL survey recently conducted by the Pew Research Center shows that the wealthier you are, the less likely you are to be religious.There seems to be a balance between religion as a positive force in increasing productivity by fostering attitudes like responsibility and self-reliance, versus religion as a negative force because it sucks up so much money from the private sector.

The survey, done as part of the Pew Global Attitudes Project, covers a wide swath of economic matters, including global trade and immigration (pewglobal.org).

Pew found that there is “a strong relationship between a country’s religiosity and its economic status.” The poorer a country, the more “religion remains central to the lives of individuals, while secular perspectives are more common in richer nations.”

The United States is the “most notable” exception. Other exceptions are oil-rich, mostly Muslim nations like Kuwait.

There is no simple interpretation of the findings. Perhaps as “people get less religious, they get wealthier,” wrote Kevin Drum of the Washington Monthly’s Political Animal blog (washingtonmonthly.com). “Or perhaps the other way around. Or perhaps there’s something else behind both trends.”

Mr. Drum concludes that it’s “probably a bit of all three.”

The authors turn next to the assessment of how differences in religiosity affect economic growth. For given religious beliefs, increases in church attendance tend to reduce economic growth. In contrast, for given church attendance, increases in some religious beliefs -- notably heaven, hell, and an afterlife -- tend to increase economic growth. In other words, economic growth depends mainly on the extent of believing relative to belonging. The authors also find some indication that the fear of hell is more potent for economic growth than the prospect of heaven. Their statistical analysis allows them to argue that these estimates reflect causal influences from religion to economic growth and not the reverse.The inverse relationship even holds within states of the US (also here, bottom graph). The South is notorious for its teen pregnancy rates, poverty, obesity, murder rates, etc., all being the highest in any region of the country. Its religiosity is also higher than any region in the country.

Barro and McCleary suggest that higher rates of religious beliefs stimulate growth because they help to sustain aspects of individual behavior that enhance productivity. They believe that higher church attendance depresses growth because it signifies a greater use of resources by the religion sector. However, that suppression of growth is tempered by the extent to which church attendance leads to greater religious beliefs, which in turn encourages economic growth.

As Charles points out, the same inverse correlation exists between education level and religiosity as wealth and religiosity, since higher education is causative of higher wealth. It's important not to confuse correlation with causation, but it's also important not to dismiss correlation because in studying it you will usually discover underlying causes.

As far back as June 2006 I commented on Gregory Paul's study in Nov 2005 that purported to show that increased religiosity is correlated with many negative sociological variables. A discussion over on the GC message board got started on this very paper just this past week and I jumped into the fray with the following observations (most of which I've reiterated here on this site before). I like to read about sociological studies and religion. The good news is that globally, godlessness is on the rise:

The evangelical authors of the WCE lament that no Christian "in 1900 expected the massive defections from Christianity that subsequently took place in Western Europe due to secularism…. and in the Americas due to materialism…. The number of nonreligionists…. throughout the 20th century has skyrocketed from 3.2 million in 1900, to 697 million in 1970, and on to 918 million in AD 2000…. Equally startling has been the meteoritic growth of secularism…. Two immense quasi-religious systems have emerged at the expense of the world's religions: agnosticism…. and atheism…. From a miniscule presence in 1900, a mere 0.2% of the globe, these systems…. are today expanding at the extraordinary rate of 8.5 million new converts each year, and are likely to reach one billion adherents soon. A large percentage of their members are the children, grandchildren or the great-great-grandchildren of persons who in their lifetimes were practicing Christians" (italics added). (The WCE probably understates today's nonreligious. They have Christians constituting 68-94% of nations where surveys indicate that a quarter to half or more are not religious, and they may overestimate Chinese Christians by a factor of two. In that case the nonreligious probably soared past the billion mark already, and the three great faiths total 64% at most.)Ditto here at home in the US:

Far from providing unambiguous evidence of the rise of faith, the devout compliers of the WCE document what they characterize as the spectacular ballooning of secularism by a few hundred-fold! It has no historical match. It dwarfs the widely heralded Mormon climb to 12 million during the same time, even the growth within Protestantism of Pentecostals from nearly nothing to half a billion does not equal it.

The survey finds that the number of people who say they are unaffiliated with any particular faith today (16.1%) is more than double the number who say they were not affiliated with any particular religion as children. Among Americans ages 18-29, one-in-four say they are not currently affiliated with any particular religion.From Barna:

The proportion of atheists and agnostics increases from 6% of Elders (ages 61+) and 9% of Boomers (ages 42-60), to 14% of Busters (23-41) and 19% of adult Mosaics (18-22).From CUNY's ARIS survey:

the greatest increase in absolute as well as in percentage terms has been among those adults who do not subscribe to any religious identification; their number has more than doubled from 14.3 million in 1990 to 29.4 million in 2001; their proportion has grown from just eight percent of the total in 1990 to over fourteen percent in 2001If this trend continues, younger Americans are going to grow more secular with time and as older Americans die off, the US will no longer be so religious because younger Americans are so much less religious than their forebears. The trends are already pointing that way.

Some people would argue that religion really is the opiate of the poor masses, and that economic standing best explains all the other negatives. That sounds more plausible to me. Poverty = less education = more religion. It is just hilarious, because the very moral failures that the "values voters" here in the South decry the loudest they exemplify the most (divorce, teen pregnancy, gun violence...) and they propose religion as a panacea, when the existence of their own abundant religiosity proves it to be otherwise.

But, until secular Americans start to learn how to organize and become a political force as the religious learned long ago, we'll continue to be underrepresented in Congress and undervalued as a slice of the electorate.

Wednesday, October 22, 2008

Pretty random thing

After I corrected his notion that all believers in sound biology are necessarily non-believers in an afterlife, I used the frequent parallel between "before you were born" and "after you die" to try to explain what it means to lose consciousness.

By coincidence, Sunday, I read this article in SciAm: "Never Say Die - Why We Can't Imagine Death".

Today, I saw this and giggled.

Tuesday, October 21, 2008

The erosion of honor

The NYT Magazine will apparently be printing a story on the failures in McCain's campaign, but I'm more interested in the failures in his character. The smear campaign that he is now running, which Barack hasn't turned back against him as effectively as he could have, has really hit bottom.

McCain used to be an honorable kind of guy. That is, if you ignore the ugly affair and divorce and a few personal failings, including a Senate Ethics investigation. However, in politics, he seemed the type not to capitulate principles for political gain. What we've seen over the past few months is the erosion of this honor and an evolution into a "win at any cost" liar of epic proportions.

McCain capitulated piecemeal: by hiring on the Bush crew to run his campaign, then this summer moving up wedge/smear-artist and Karl Rove's 2004 assistant Steve Schmidt to run the campaign and finally giving up his last remaining vestige of honor last month in hiring Eskew and the crew who smeared him in SC during the 2000 GOP primary, giving himself over to their Rove-Atwater tactics. And we see the fruits of it in Palin's recent "palling around with terrorists" and other BS. The coup de grâce, and this is truly amazing, is that McCain went beyond the typical dirty politics of using third-party groups to do robocalls by doing them himself (after complaining years ago about this)...and even hired the same crew who smeared him in 2000.

Whatever McCain once was, he is no more.

Monday, October 20, 2008

Fannie & Freddie lobbied the GOP to shut down regulation in 2005

Freddie Mac secretly paid a Republican consulting firm $2 million to kill legislation that would have regulated and trimmed the mortgage finance giant and its sister company, Fannie Mae, three years before the government took control to prevent their collapse.Spin that.

In the cross hairs of the campaign carried out by DCI of Washington were Republican senators and a regulatory overhaul bill sponsored by Sen. Chuck Hagel, R-Neb. DCI's chief executive is Doug Goodyear, whom John McCain's campaign later hired to manage the GOP convention in September.

Freddie Mac's payments to DCI began shortly after the Senate Banking, Housing and Urban Affairs Committee sent Hagel's bill to the then GOP-run Senate on July 28, 2005. All GOP members of the committee supported it; all Democrats opposed it.

In the midst of DCI's yearlong effort, Hagel and 25 other Republican senators pleaded unsuccessfully with Senate Majority Leader Bill Frist, R-Tenn., to allow a vote.

"If effective regulatory reform legislation ... is not enacted this year, American taxpayers will continue to be exposed to the enormous risk that Fannie Mae and Freddie Mac pose to the housing market, the overall financial system and the economy as a whole," the senators wrote in a letter that proved prescient.

Unknown to the senators, DCI was undermining support for the bill in a campaign targeting 17 Republican senators in 13 states, according to documents obtained by The Associated Press. The states and the senators targeted changed over time, but always stayed on the Republican side.

In the end, there was not enough Republican support for Hagel's bill to warrant bringing it up for a vote because Democrats also opposed it and the votes of some would be needed for passage. The measure died at the end of the 109th Congress.

McCain, R-Ariz., was not a target of the DCI campaign. He signed Hagel's letter and three weeks later signed on as a co-sponsor of the bill.

By the time McCain did so, however, DCI's effort had gone on for nine months and was on its way toward killing the bill.

In recent days, McCain has said Freddie Mac and Fannie Mae were "one of the real catalysts, really the match that lit this fire" of the global credit crisis. McCain has accused Democratic presidential candidate Barack Obama of taking advice from former executives of Fannie Mae and Freddie Mac, and failing to see that the companies were heading for a meltdown.

McCain’s campaign manager, Rick Davis, or his lobbying firm has taken more than $2 million from Fannie Mae and Freddie Mac dating to 2000. In December, Freddie Mac contributed $250,000 to last month’s GOP convention.

Sunday, October 12, 2008

Continuing to misplace blame

Today provides another refutation of these conservative talking points:

Private sector loans, not Fannie or Freddie, triggered crisisDon't let the facts get in the way of a good story line...Faux News.

By David Goldstein and Kevin G. Hall | McClatchy Newspapers

WASHINGTON — As the economy worsens and Election Day approaches, a conservative campaign that blames the global financial crisis on a government push to make housing more affordable to lower-class Americans has taken off on talk radio and e-mail.

Commentators say that's what triggered the stock market meltdown and the freeze on credit. They've specifically targeted the mortgage finance giants Fannie Mae and Freddie Mac, which the federal government seized on Sept. 6, contending that lending to poor and minority Americans caused Fannie's and Freddie's financial problems.

Federal housing data reveal that the charges aren't true, and that the private sector, not the government or government-backed companies, was behind the soaring subprime lending at the core of the crisis.

Subprime lending offered high-cost loans to the weakest borrowers during the housing boom that lasted from 2001 to 2007. Subprime lending was at its height from 2004 to 2006.

Federal Reserve Board data show that:

- More than 84 percent of the subprime mortgages in 2006 were issued by private lending institutions.

- Private firms made nearly 83 percent of the subprime loans to low- and moderate-income borrowers that year.

The "turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007," the President's Working Group on Financial Markets reported Friday.

- Only one of the top 25 subprime lenders in 2006 was directly subject to the housing law that's being lambasted by conservative critics.

Conservative critics claim that the Clinton administration pushed Fannie Mae and Freddie Mac to make home ownership more available to riskier borrowers with little concern for their ability to pay the mortgages.

"I don't remember a clarion call that said Fannie and Freddie are a disaster. Loaning to minorities and risky folks is a disaster," said Neil Cavuto of Fox News.

Fannie, the Federal National Mortgage Association, and Freddie, the Federal Home Loan Mortgage Corp., don't lend money, to minorities or anyone else, however. They purchase loans from the private lenders who actually underwrite the loans.

It's a process called securitization, and by passing on the loans, banks have more capital on hand so they can lend even more.

This much is true. In an effort to promote affordable home ownership for minorities and rural whites, the Department of Housing and Urban Development set targets for Fannie and Freddie in 1992 to purchase low-income loans for sale into the secondary market that eventually reached this number: 52 percent of loans given to low-to moderate-income families.

To be sure, encouraging lower-income Americans to become homeowners gave unsophisticated borrowers and unscrupulous lenders and mortgage brokers more chances to turn dreams of homeownership in nightmares.

But these loans, and those to low- and moderate-income families represent a small portion of overall lending. And at the height of the housing boom in 2005 and 2006, Republicans and their party's standard bearer, President Bush, didn't criticize any sort of lending, frequently boasting that they were presiding over the highest-ever rates of U.S. homeownership.

Between 2004 and 2006, when subprime lending was exploding, Fannie and Freddie went from holding a high of 48 percent of the subprime loans that were sold into the secondary market to holding about 24 percent, according to data from Inside Mortgage Finance, a specialty publication. One reason is that Fannie and Freddie were subject to tougher standards than many of the unregulated players in the private sector who weakened lending standards, most of whom have gone bankrupt or are now in deep trouble.

During those same explosive three years, private investment banks — not Fannie and Freddie — dominated the mortgage loans that were packaged and sold into the secondary mortgage market. In 2005 and 2006, the private sector securitized almost two thirds of all U.S. mortgages, supplanting Fannie and Freddie, according to a number of specialty publications that track this data.

In 1999, the year many critics charge that the Clinton administration pressured Fannie and Freddie, the private sector sold into the secondary market just 18 percent of all mortgages.

Fueled by low interest rates and cheap credit, home prices between 2001 and 2007 galloped beyond anything ever seen, and that fueled demand for mortgage-backed securities, the technical term for mortgages that are sold to a company, usually an investment bank, which then pools and sells them into the secondary mortgage market.

About 70 percent of all U.S. mortgages are in this secondary mortgage market, according to the Federal Reserve.

Conservative critics also blame the subprime lending mess on the Community Reinvestment Act, a 31-year-old law aimed at freeing credit for underserved neighborhoods.

Congress created the CRA in 1977 to reverse years of redlining and other restrictive banking practices that locked the poor, and especially minorities, out of homeownership and the tax breaks and wealth creation it affords. The CRA requires federally regulated and insured financial institutions to show that they're lending and investing in their communities.

Conservative columnist Charles Krauthammer wrote recently that while the goal of the CRA was admirable, "it led to tremendous pressure on Fannie Mae and Freddie Mac — who in turn pressured banks and other lenders — to extend mortgages to people who were borrowing over their heads. That's called subprime lending. It lies at the root of our current calamity."

Fannie and Freddie, however, didn't pressure lenders to sell them more loans; they struggled to keep pace with their private sector competitors. In fact, their regulator, the Office of Federal Housing Enterprise Oversight, imposed new restrictions in 2006 that led to Fannie and Freddie losing even more market share in the booming subprime market.

What's more, only commercial banks and thrifts must follow CRA rules. The investment banks don't, nor did the now-bankrupt non-bank lenders such as New Century Financial Corp. and Ameriquest that underwrote most of the subprime loans.

These private non-bank lenders enjoyed a regulatory gap, allowing them to be regulated by 50 different state banking supervisors instead of the federal government. And mortgage brokers, who also weren't subject to federal regulation or the CRA, originated most of the subprime loans.

In a speech last March, Janet Yellen, the president of the Federal Reserve Bank of San Francisco, debunked the notion that the push for affordable housing created today's problems.

"Most of the loans made by depository institutions examined under the CRA have not been higher-priced loans," she said. "The CRA has increased the volume of responsible lending to low- and moderate-income households."

In a book on the sub-prime lending collapse published in June 2007, the late Federal Reserve Governor Ed Gramlich wrote that only one-third of all CRA loans had interest rates high enough to be considered sub-prime and that to the pleasant surprise of commercial banks there were low default rates. Banks that participated in CRA lending had found, he wrote, "that this new lending is good business."

While I agree 100% that people weren't realistic about what they could afford and don't deserve a cent in bailout money, the fact of the matter is that lenders chose to extend mortgages to these people without abiding by standards that have existed for decades. It didn't used to be an issue because if you couldn't afford a mortgage, the bank knew it and wouldn't give it to you. This article makes it a little harder to argue with a straight face that it's all the fault of Fannie and Freddie, who just bought up bundled mortgages from lenders.

Saturday, October 11, 2008

Survey of the damage

It's getting difficult to guard the optimism

One of the neat things you can do is go to 270towin and play with the states to see various outcomes for the election. Taking for granted a win in all the 2004 Kerry states, it appears that Obama has also solidly locked in Iowa and New Mexico, bringing him to 264 EV. Amazingly, all Obama has to do is win one of the remaining tossup states: FL, OH, VA, NC, IN, CO, NV, or MO. McCain has to sweep every one of these swing states to win...and that's why sites that run probabilities like fivethirtyeight have Obama winning with 9:1 odds given current polling data.

Basically, my predicted map is shown below, in which Obama wins OH but loses FL, wins VA but loses NC, wins CO but loses NV, wins 1 of the 5 NE districts (Omaha) but loses both MO and IN. This would give Obama 307 EV to McCain's 231. I also predict Obama to win around 51% of the popular vote and I think McCain will get around 48.5%, with third-party candidates drawing less than expected due to the financial crisis:

Aren't prognostications fun?

Aren't prognostications fun?And here's a countdown clock for the election:

Golden line

Palin has been pressing the line that people don’t really know “the real Barack Obama,” and who could make the argument better than a woman who we’ve already known for almost six weeks? Really, she’s like one of the family.*drum sting*

We’ve gotten so close we’ve already learned that she didn’t actually sell the plane on eBay, didn’t actually visit the troops in Iraq and didn’t really have a talk with the British ambassador. As soon as we get the Trooper thing and Alaska Independence Party thing and the tax thing figured out, she’ll be an open book.

PS: Economists who once backed McCain's economic plans are now balking at his proposal to buy mortgages directly from banks.

PSS: Someone should lose a hand (or at least a finger) over this.

Friday, October 10, 2008

Politics notes

The whole ACORN thing deconstructed.

After seeing his inflammatory rhetoric result in lots of blowback, Sen. McCain tried to walk back the harsh attacks on Obama's character today at a rally. He was booed. He called for "respect"...simultaneously, and with no hint of irony, McCain is running the "blind ambition" ad accusing Obama of "lying" about Ayers. Not that they'll bother to document this "lie" since it would expose their own.

Meanwhile, Cindy broke the irony meter when accusing Obama of running "the dirtiest campaign ever..."

Maybe Obama should release a video smearing Palin? Never mind.

Nobel Prize-winning economist Joe Stiglitz explains the causes of the current financial crisis:

The new populist rhetoric of the right—persuading taxpayers that ordinary people always know how to spend money better than the government does, and promising a new world without budget constraints, where every tax cut generates more revenue—hasn’t helped matters. Special interests took advantage of this seductive mixture of populism and free-market ideology. They also bent the rules to suit themselves. Corporations and the wealthy argued that lowering their tax rates would lead to more savings; they got the tax breaks, but America’s household savings rate not only didn’t rise, it dropped to levels not seen in 75 years. The Bush administration extolled the power of the free market, but it was more than willing to provide generous subsidies to farmers and erect tariffs to protect steelmakers. Lately, as we have seen, it seems willing to write blank checks to bail out its friends on Wall Street. In each of these cases there are clear winners. And in each there are clear losers—including the country as a whole.BTW, Stiglitz is the most-cited economist in the world.

...

The federal government needs to give a hand to states and localities—their tax revenues are plummeting, and without help they will face costly cutbacks in investment and in basic human services. The poor will suffer today, and growth will suffer tomorrow. The big advantage of a program to make up for the shortfall in the revenues of states and localities is that it would provide money in the amounts needed: if the economy recovers quickly, the shortfall will be small; if the downturn is long, as I fear will be the case, the shortfall will be large.

These measures are the opposite of what the administration—along with the Republican presidential nominee, John McCain—has been urging. It has always believed that tax cuts, especially for the rich, are the solution to the economy’s ills. In fact, the tax cuts in 2001 and 2003 set the stage for the current crisis. They did virtually nothing to stimulate the economy, and they left the burden of keeping the economy on life support to monetary policy alone. America’s problem today is not that households consume too little; on the contrary, with a savings rate barely above zero, it is clear we consume too much. But the administration hopes to encourage our spendthrift ways.

What has happened to the American economy was avoidable. It was not just that those who were entrusted to maintain the economy’s safety and soundness failed to do their job. There were also many who benefited handsomely by ensuring that what needed to be done did not get done. Now we face a choice: whether to let our response to the nation’s woes be shaped by those who got us here, or to seize the opportunity for fundamental reforms, striking a new balance between the market and government.

Wednesday, October 8, 2008

Politics notes

This year's presidential election is among the most significant in our nation's history. The country urgently needs a visionary leader who can ensure the future of our traditional strengths in science and technology and who can harness those strengths to address many of our greatest problems: energy, disease, climate change, security, and economic competitiveness.Do remember that my question to CNN involved retaining the USA's status as a scientific superpower.

We are convinced that Senator Barack Obama is such a leader, and we urge you to join us in supporting him.

During the administration of George W. Bush, vital parts of our country's scientific enterprise have been damaged by stagnant or declining federal support. The government's scientific advisory process has been distorted by political considerations. As a result, our once dominant position in the scientific world has been shaken and our prosperity has been placed at risk. We have lost time critical for the development of new ways to provide energy, treat disease, reverse climate change, strengthen our security, and improve our economy.

We have watched Senator Obama's approach to these issues with admiration. We especially applaud his emphasis during the campaign on the power of science and technology to enhance our nation's competitiveness. In particular, we support the measures he plans to take – through new initiatives in education and training, expanded research funding, an unbiased process for obtaining scientific advice, and an appropriate balance of basic and applied research – to meet the nation's and the world's most urgent needs.

Senator Obama understands that Presidential leadership and federal investments in science and technology are crucial elements in successful governance of the world's leading country. We hope you will join us as we work together to ensure his election in November.

Following up an earlier item on blaming the poor and minorities for the current financial crisis, Newsweek tackles the argument head-on:

Indeed.The Community Reinvestment Actapplies to depository banks. But many of the institutions that spurred the massive growth of the subprime market weren't regulated banks. They were outfits such as Argent and American Home Mortgage, which were generally not regulated by the Federal Reserve or other entities that monitored compliance with CRA. These institutions worked hand in glove with Bear Stearns and Lehman Brothers, entities to which the CRA likewise didn't apply. There's much more. As Barry Ritholtz notes in this fine rant, the CRA didn't force mortgage companies to offer loans for no-money down, or to throw underwriting standards out the window, or to encourage mortgage brokers to aggressively seek out new markets. Nor did the CRA force the credit-rating agencies to slap high-grade ratings on subprime debt.

Second, many of the biggest flameouts in real estate have had nothing to do with subprime lending. WCI Communities, builder of highly amenitized condos in Florida (no subprime purchasers welcome there), filed for bankruptcy in August. Very few of the tens of thousands of now-surplus condominiums in Miami were conceived to be marketed to subprime borrowers, or minorities—unless you count rich Venezuelans and Colombians as minorities. The multi-year plague that has been documented in brilliant detail at IrvineHousingBlog is playing out in one of the least subprime housing markets in the nation.

Third, lending money to poor people and minorities isn't inherently risky. There's plenty of evidence that in fact it's not that risky at all. That's what we've learned from several decades of microlending programs, at home and abroad, with their very high repayment rates. And as The New York Times recently reported, Nehemiah Homes, a long-running initiative to build homes and sell them to the working poor in subprime areas of New York's outer boroughs, has a repayment rate that lenders in Greenwich, Conn., would envy. In 27 years, there have been fewer than 10 defaults on the project's 3,900 homes. That's a rate of 0.25 percent.

On the other hand, lending money recklessly to obscenely rich white guys, such as Richard Fuld of Lehman Brothers, or Jimmy Cayne of Bear Stearns, can be really risky. In fact, it's even more risky, since they have a lot more borrowing capacity. And, here, again, it's difficult to imagine how Jimmy Carter could be responsible for the supremely poor decision-making seen in the financial system. I await the Krauthammer column in which he points out the specific provision of the Community Reinvestment Act that forced Bear Stearns to run with an absurd leverage ratio of 33:1, that instructed Bear Stearns hedge-fund managers to blow up hundreds of millions of their clients money, and that required its septuagenarian CEO to play bridge while his company ran into trouble. Perhaps Neil Cavuto knows which CRA clause required Lehman Brothers to borrow hundreds of billions of dollars in short-term debt in the capital markets and then buy tens of billions of dollars of commercial real estate at the top of the market. I can't find it. Did AIG plunge into the credit-default swaps business with abandon because ACORN members picketed its offices? Please. How about the hundreds of billions of dollars of leveraged loans—loans banks committed to private equity firms that wanted to conduct leveraged buyouts of retailers, restaurant companies, and industrial firms? Many of those are going bad now, too. Is that Bill Clinton's fault?

Tuesday, October 7, 2008

Polls show a very good chance to win for Obama

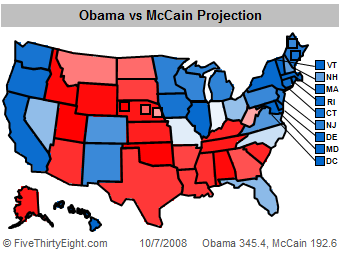

fivethirtyeight.com's current analysis has him at 345 and pollster.com has him at 320.

As a supporter who has seen a lot since January 2007, it is amazing and I never knew if we'd ever get here. Like many Dems, there's a nervous gnawing sense that something will go wrong. But I just think, despite the best efforts of Faux Noise and the right wing, Obama will win absent a cataclysmic new revelation or gaffe during a debate. The problem for McCain is that the voters are, by now, almost all cemented in their choices with very few undecideds left and very few "swayable" decideds.

I'm showing two maps below:

fivethirtyeight's map:

And Pollster's map, which currently (10/7) gives Obama 320 with 55 tossup:

...my fingers remain crossed...

Monday, October 6, 2008

Keating economics: McCain's defining scandal

keatingeconomics.com

Here is the video link to the 13-min documentary and here is the video link to the 35-sec preview/trailer. The full 13-min documentary is embedded below:

Sunday, October 5, 2008

McCain's shady associations and bad judgment

So it seems that the McCain campaign will be slinging as much mud as possible in its last desperate attempt to win. They're now dialing up the volume on Obama's "character and judgment" based on his past associations.

Okay, let's play.

Palin is talking about Ayers. If talking about William Ayers, a man Obama barely knows and met as a fellow Professor at the University of Chicago, is germane then surely talking about Charles Keating is. The fact that McCain was formally investigated by the Senate Ethics Committee, while Obama has never been formally investigated by any panel, despite all the media digging, is telling. It's also telling that McCain's running mate is under ethics investigations, (despite all the stonewalling) as well.

If talking about how Rezko helped Obama by buying a part of his parcel then later re-selling it to him at fair market value is germane, then surely talking about how McCain's first failed marriage, followed by his mistress-turned-wife Cindy and her father launched McCain's campaign with their own money, then invested $350K into a Keating shopping mall in April 1986 is.

And it isn't like McCain's ability to be bought off by corporations ended 20 years ago. Far from it. In 1998 and 1999, McCain worked hard on behalf of a corporation with a hot lobbyist, writing letters to the FCC to push for deregulation to make those companies more money. Vicki Iseman (very sexy lady) schmoozed McCain for years, herself working as a lobbyist for Paxson and Glencairn, telecom companies who benefitted from McCain's influence to deregulate the telecom industry. Rumors abounded that McCain was fu&*ing the broad, but whether or not that's true, he definitely did her clients favors.

I just don't know if the McCain campaign wants to go down this road. If they do, then it's past time to counter-punch. Given the relevance of the McCain's ties to the S&L banking scandal of the 1980's and his ties to today's financial crisis through Phil Gramm and deregulation, I say, as King George famously said, "Bring 'em on."

Saturday, October 4, 2008

Economists favor Obama by huge margins

The detailed responses are bad news for Mr McCain (the full data are available here). Eighty per cent of respondents and no fewer than 71% of those who do not cleave to either main party say Mr Obama has a better grasp of economics. Even among Republicans Mr Obama has the edge: 46% versus 23% say Mr Obama has the better grasp of the subject.A nice thing to mention on the campaign trail. Plus the fact that McCain is advised by a bunch of financial lobbyists, while Obama is endorsed by economists 2:1 over McCain.

...

A candidate’s economic expertise may matter rather less if he surrounds himself with clever advisers. Unfortunately for Mr McCain, 81% of all respondents reckon Mr Obama is more likely to do that; among unaffiliated respondents, 71% say so.

...

On our one-to-five scale, economists on average give Mr Obama’s economic programme a 3.3 and Mr McCain’s a 2.2. Mr Obama, says Jonathan Parker, a non-aligned professor at Northwestern’s Kellogg School of Management, “is a pragmatist not an ideologue. I expect Clintonian economic policies.” If, that is, crushing federal debt does not derail his taxing and spending plans.

On his plans to fix the financial crisis, Mr Obama averages 3.1, a point higher than Mr McCain. Still, some said they didn’t quite know what they were rating—reasonably enough, since neither candidate has produced clear plans of his own.

Where the candidates’ positions are more clearly articulated, Mr Obama scores better on nearly every issue: promoting fiscal discipline, energy policy, reducing the number of people without health insurance, controlling health-care costs, reforming financial regulation and boosting long-run economic growth. Twice as many economists think Mr McCain’s plan would be bad or very bad for long-run growth as Mr Obama’s. Given how much focus Mr McCain has put on his plan’s benefits for growth, this last is quite a repudiation.

Mr McCain gets his highest mark, an average of 3.5 and a clear advantage over Mr Obama, for his position on free trade and globalisation. If Mr Obama “would wake up on free trade”, one respondent says, “I could get behind the plans much more.” Perhaps surprisingly, the economists rated trade low in priority compared with the other issues listed. Only 53% say it is important or very important. Neither candidate scored at all well on dealing with the burgeoning cost of entitlements such as Medicare and Social Security.

The economists also prefer Mr Obama’s tax plans. Republicans and respondents who do not identify with either political party see Mr McCain’s tax policies as more efficient but less equitable. But the former prefer Mr McCain’s plans—43% of Republicans say they are good or very good—and the latter Mr Obama’s. Of non-affiliated respondents, 31% say Mr Obama’s are good or very good.

Either way, according to the economists, it would be difficult to do much worse than George Bush. The respondents give Mr Bush a dismal average of 1.7 on our five-point scale for his economic management. Eighty-two per cent thought Mr Bush’s record was bad or very bad; only 1% thought it was very good.

The Democrats were overwhelmingly negative, but nearly every respondent viewed Mr Bush’s record unfavourably. Half of Republican respondents thought Mr Bush deserves only a 2. “The minimum rating of one severely overestimates the quality of Bush’s economic policies,” says one non-aligned economist.