"Busteed said that 96 percent of the college provosts Gallup surveyed believed their schools were successfully preparing young people for the workplace. “When you ask recent college grads in the work force whether they felt prepared, only 14 percent say ‘yes,’ ” he added. And then when you ask business leaders whether they’re getting enough college grads with the skills they need, “only 11 percent strongly agree.” Concluded Busteed: “This is not just a skills gap. It is an understanding gap.” ...the success stories shared a lot of the same attributes that Gallup found to be differentiating. In successful programs, said Auguste, “students got as much applied, hands-on experience as possible, whether in a classroom or on a job site. Schools, colleges and training centers had close partnerships with regional employers, industry groups and skilled trade unions to stay up to date on job-relevant skills. And students or working learners got a lot of coaching and guidance to understand how to trace a direct path between their training today and careers tomorrow.”Pretty discouraging...

Showing posts with label economics. Show all posts

Showing posts with label economics. Show all posts

Wednesday, September 10, 2014

Dismal Disconnect

I read the other day that 80-some percent of college graduates do not have a job lined up after May. This is not surprising. Today I was reading that solutions to this problem look far and away, since colleges, students, and employers do not share the same perspectives:

Monday, July 7, 2014

Commitments

When do beliefs and facts collide?

When you decide at the outset that something is true, your commitment may blind you to contrary evidence and rational expectations. Let's compare the intellectual commitments of science versus, say, politics or religion: In science, we presume the uniformity of nature. This means we assume that the laws of gravity, electromagnetism, etc., are fundamental properties of the universe, rather than contingent features that are subject to change. This presumption is useful because it allows us to interpolate and extrapolate data. A simple example would be inferring the age of the earth from geological processes, or isotope decay, or measuring the distance to stars. This premise is very, very difficult to falsify.

And that's the beauty of skepticism: start with very basic assumptions, and continue to question them as new evidence and information arises. Religious belief is quite different for two main reasons: 1) some religions require obedience and faith that is defined as without evidence, and 2) the commitments of religious people are sometimes so complex that they don't even realize how difficult their position is to defend. The first reason is rather clear and doesn't need much elaboration, in the sense that belief in a Garden of Eden or Resurrection or whatever clearly defies common sense and every scientific principle known to man.

When you decide at the outset that something is true, your commitment may blind you to contrary evidence and rational expectations. Let's compare the intellectual commitments of science versus, say, politics or religion: In science, we presume the uniformity of nature. This means we assume that the laws of gravity, electromagnetism, etc., are fundamental properties of the universe, rather than contingent features that are subject to change. This presumption is useful because it allows us to interpolate and extrapolate data. A simple example would be inferring the age of the earth from geological processes, or isotope decay, or measuring the distance to stars. This premise is very, very difficult to falsify.

And that's the beauty of skepticism: start with very basic assumptions, and continue to question them as new evidence and information arises. Religious belief is quite different for two main reasons: 1) some religions require obedience and faith that is defined as without evidence, and 2) the commitments of religious people are sometimes so complex that they don't even realize how difficult their position is to defend. The first reason is rather clear and doesn't need much elaboration, in the sense that belief in a Garden of Eden or Resurrection or whatever clearly defies common sense and every scientific principle known to man.

Sunday, June 22, 2014

Fear the robots

Will automation accelerate the concentration of capital, skewing inequality further and destablizing democracy? Probably.

Krugman also thinks so. (also: here, here, here, here, here, here)

An aside: When the best conservative minds at Forbes decry this assessment by pleading,

Fear of change, especially technologically-driven change, conjures images of the Luddites and Amish. It goes back. Life Magazine from July 19, 1963: article by Keith Wheeler on automation screams, "Impact of Automation: Its Accelerating Effects have Pushed Our Society to the Point of No Return"

I lean towards Krugman and Life, although I am hopeful that humanity will surprise me.

Krugman also thinks so. (also: here, here, here, here, here, here)

An aside: When the best conservative minds at Forbes decry this assessment by pleading,

"If we’ve pretty much abolished material scarcity then of course real wages have just soared. Real wages being, really, a measure of how much consumption is possible rather than the nominal value of earnings. If you are of a Marxist persuasion you might think that all of the money from those androids will just go to capital, leaving the workers starving and destitute without any jobs and thus not earning at all. But to do that you would have to believe in Monopoly Capitalism, this idea that the capitalists as a class will gang up on everyone else and keep all the good stuff for themselves. But note that this does depend upon that monopoly."... then you should worry. Or should we not fear the robots? Steven Rattner says so.

Fear of change, especially technologically-driven change, conjures images of the Luddites and Amish. It goes back. Life Magazine from July 19, 1963: article by Keith Wheeler on automation screams, "Impact of Automation: Its Accelerating Effects have Pushed Our Society to the Point of No Return"

I lean towards Krugman and Life, although I am hopeful that humanity will surprise me.

Monday, September 23, 2013

Two great articles on partisanship and food stamps

Two great new opinion pieces from the NYT:

- http://opinionator.blogs.nytimes.com/2013/09/21/american-bile/

- http://opinionator.blogs.nytimes.com/2013/09/19/red-state-pain/

Sunday, July 21, 2013

What the internet does

Not going to try to make a deep post here. I think we all forget sometimes just how radically the internet has upset the world. Its full effects have still not shaken out.

Saturday, May 11, 2013

The collapse of the Republican intellectual edifice

Facts haven't been kind to Republican ideology lately. For years, really, the eminent apocalypse upon which they depend has failed to materialize (like Jesus, lol). Chait walks us through the details:

Wednesday, May 1, 2013

A brave new world

Friedman is not my favorite columnist by a long shot. Many times I glance at his column and think, "He's recycled this garbage again?" He seems to repeat the same thing about our world being "hyperconnected" and "flat" every week, and just looks at a different implication of it: education, industry, entrepreneurship, etc.

But this week I liked the way he summarized things: we live in "A brave new 401(k) world, where we all take the bar exam, and are measured by the most-emailed list." His explanation follows (my emphasis added in bold):

But this week I liked the way he summarized things: we live in "A brave new 401(k) world, where we all take the bar exam, and are measured by the most-emailed list." His explanation follows (my emphasis added in bold):

Sunday, March 17, 2013

Efficiency of capitalism?

Richard Wolff writes:

Less inequality among and within societies and increased efficiency that benefits everyone with less work and more or different output: these goals require confronting the capitalist system. The particular capitalist way of organizing how goods and services get produced and distributed and who makes the key decisions is the problem. What, how and where to produce and how to use the profits are those key decisions. To serve most people, those decisions must be made by most people. To do that requires converting capitalist into co-operative enterprises where workers become their own collective board of directors. Workers self-directed enterprises would be far less likely to relocate production, far less likely to distribute profits among workers in extremely unequal ways, and far less likely to install technologies with negative impacts on the environment in which they, their families, and their communities live. Democratizing the economy in this way can yield the kinds of economic and social results that capitalism has long promised – but increasingly fails to deliver.Indeed. Some more thoughts on this topic.

Tuesday, February 19, 2013

Procrustean Bed

I like Taleb. He was a lot like Roubini back in the day (07-08). And his collected sayings are definitely worth consideration:

- “Academia is to knowledge what prostitution is to love; close enough on the surface but, to the non-sucker, not exactly the same thing.”

- “Social media are severely antisocial, health foods are empirically unhealthy, knowledge workers are very ignorant, and social sciences aren’t scientific at all.”

- “In science you need to understand the world; in business you need others to misunderstand it.”

- “Education makes the wise slightly wiser, but it makes the fool vastly more dangerous.”

- “In nature we never repeat the same motion; in captivity (office, gym, commute, sports), life is just repetitive-stress injury. No randomness.”

- “Economics cannot digest the idea that the collective (and the aggregate) are disproportionately less predictable than individuals.”

- “Catholic countries had more serial monogamy than today, but without the need for divorce—life expectancy was short; marriage duration was much, much shorter. “

- “You never win an argument until they attack your person.”

- “The characteristic feature of the loser is to bemoan, in general terms, mankind’s flaws, biases, contradictions, and irrationality—without exploiting them for fun and profit.”

- “To be completely cured of newspapers, spend a year reading the previous week’s newspapers.”

- “People focus on role models; it is more effective to find antimodels—people you don’t want to resemble when you grow up.”

- “The three most harmful addictions are heroin, carbohydrates, and a monthly salary. My only measure of success is how much time you have to kill.”

- “Some books cannot be summarized (real literature, poetry); some can be compressed to about ten pages; the majority to zero pages.”

- “They think that intelligence is about noticing things that are relevant (detecting patterns); in a complex world, intelligence consists in ignoring things that are irrelevant (avoiding false patterns).”

- “The best way to spot a charlatan: someone (like a consultant or a stockbroker) who tells you what to do instead of what not to do.”

- “The main difference between government bailouts and smoking is that in some rare cases the statement ‘this is my last cigarette’ holds true.”

Friday, January 11, 2013

Mint the coin already

A debt ceiling bypass idea that I wrote about on January 2 that may have sounded "fringe" is now clearly mainstream: bypass the debt ceiling fight altogether using legal means. Don't let the Republicans' brand of economic terrorism (give me what I want or I will harm innocent third parties) survive as an option any longer. In our current political calculus, Republicans control only the House -- and that largely by gerrymandering -- yet feel that having 1/3 the political power entitles them to use the debt ceiling as 100% leverage to get further serious entitlement/spending cuts. Sadly, this is not the time to try to highlight their extremism by letting the US Govt Default date approach. Reforming that bunch is not going to happen.

So now is the time to mint the $1T platinum coin. (Or 1,000 $1B platinum coins, but why waste the metal?) And then instruct the Treasury Secretary to hold on to it and be prepared to deposit it at the Fed once the Republicans make it clear they're willing to blow up the economy if they don't get what they want. Take the debt ceiling off the table today, before all the hype and news attention centers on the fight.

Of course Republicans will scream tyranny and executive overreach. But it seems pretty clearly constitutional. And furthermore, it's Congress who racked up the bills. Tax cuts and unfunded wars and unfunded entitlement increases all happened on the Republicans watch. Now they're bitching because the Treasury has to borrow to pay the bills they incurred.

So now is the time to mint the $1T platinum coin. (Or 1,000 $1B platinum coins, but why waste the metal?) And then instruct the Treasury Secretary to hold on to it and be prepared to deposit it at the Fed once the Republicans make it clear they're willing to blow up the economy if they don't get what they want. Take the debt ceiling off the table today, before all the hype and news attention centers on the fight.

Of course Republicans will scream tyranny and executive overreach. But it seems pretty clearly constitutional. And furthermore, it's Congress who racked up the bills. Tax cuts and unfunded wars and unfunded entitlement increases all happened on the Republicans watch. Now they're bitching because the Treasury has to borrow to pay the bills they incurred.

Wednesday, January 2, 2013

How to ignore the debt ceiling

Apparently, the President has some legal room to maneuver around the ridiculous debt ceiling; the Republicans' last great flaming political football.

UPDATE: WSJ says the $1T platinum coin idea is gaining traction...

UPDATE: WSJ says the $1T platinum coin idea is gaining traction...

Friday, December 28, 2012

Marx reborn

I think the failures of hands-off capitalism are becoming more apparent by the day. Americans do not trust their government because it has failed them in privatizing to industry and lobbyists, rather than protecting the 99%. I'm not saying that centralized planning works, but I am definitely a strong proponent of regulations and holding back the race-to-the-bottom nature of unbridled capitalism. And the more time we spend watching the US-style conservatism unfold, the more Marx seems a genius.

The costs of this sort of conservatism are mounting: record-low tax rates for the rich, leading to record deficits, which only get paid for out of the pocket of the working man (cut our SS and Medicare!). Perhaps our benefits are too great, but then so is their corporate graft in the form of no-bid contracts, tax incentives to take jobs overseas, as well as skewed tax breaks given at the state and local levels, obvious moral hazards created by the government for industry (e.g., the banking regulations that led to our financial collapse), lax enforcement of securities fraud, and on and on and on and on...

If capitalists are allowed to "run amok" you will continue to see labor getting shafted. That is clearly, unequivocally and factually the case for the past forty years now (for specific wage vs productivity growth changes, see links in this column). And it only looks to get worse once robots take over 90% of all jobs.

I don't know all the answers, but the current form of so-called liberalism is dead. The Democratic Party lost its way long ago and although it continues to at least fight the forces of plutocracy it has sold its soul to them in many ways. If they can't look to grow a spine and shake free of the shackles of their big-money interests, a revolt of the proles is all but certain.

The costs of this sort of conservatism are mounting: record-low tax rates for the rich, leading to record deficits, which only get paid for out of the pocket of the working man (cut our SS and Medicare!). Perhaps our benefits are too great, but then so is their corporate graft in the form of no-bid contracts, tax incentives to take jobs overseas, as well as skewed tax breaks given at the state and local levels, obvious moral hazards created by the government for industry (e.g., the banking regulations that led to our financial collapse), lax enforcement of securities fraud, and on and on and on and on...

If capitalists are allowed to "run amok" you will continue to see labor getting shafted. That is clearly, unequivocally and factually the case for the past forty years now (for specific wage vs productivity growth changes, see links in this column). And it only looks to get worse once robots take over 90% of all jobs.

I don't know all the answers, but the current form of so-called liberalism is dead. The Democratic Party lost its way long ago and although it continues to at least fight the forces of plutocracy it has sold its soul to them in many ways. If they can't look to grow a spine and shake free of the shackles of their big-money interests, a revolt of the proles is all but certain.

Tuesday, December 11, 2012

Republican credibility on economics

I am trying to maintain composure as I read about the way that Republicans will go to their political graves to defend the rich from having ANY % increase in their income tax rate, while at the same time, raving and ranting about how the government spends more than it takes in. It hearkens back to when Republicans were falling all over themselves to defend Wall St bankers from accountability, and all I can do is shake my head. The hopelessly-confused Tea Partiers elected these clowns-in-Brooks-Brothers-suits to "fight" for them? What a sad, pathetic, sad thing to think.

One of the clearest-cut ways that wealthy people avoid paying taxes is by routing their money in complicated ways through corporate entities, especially via so-called "sub-S" corporations. By taking a small direct salary and then paying yourself through your S corporation, one can avoid paying both income and payroll taxes. The IRS has been cracking down more on this, but they cannot litigate each individual case, and so the wealthy reap enormous benefits from playing the highly favorable odds.

Consider the “Roadmap for America’s future” released by Paul Ryan, the ranking Republican on the House budget committee, and embraced by Mitt Romney. The CBPP finds that it will explode deficits and raise taxes on the middle/lower class. The hilarious thing is that I grew up always being told that Democrats just run up deficits while Republicans really safeguard the treasury of the Republic...yep, the GOP sure does know economics.

Of course Republicans cannot and will not admit that they just don't want their bankrollers to have to pay a little more in income taxes. So instead they hide behind "small business" and the supply side voodoo that used to be all the rage...in the 80s.

As Steve Benen summarizes:

And remember this as the "fiscal cliff" approaches: the Bush tax cuts were fiscally irresponsible giveaways to the wealthy. Republicans do not want them to expire on the rich. Republicans do not want to admit that they explode our deficit and debt. Republicans will consider it a major concession if the Democrats allow them to expire for the rich and will try to use that as leverage to get money out of the hands of poor and old people via Medicaid/Medicare/Social Security cuts. Somehow, some way, people actually vote for these clowns?

But Republicans don't just suffer from a lack of reality with respect to economics. They also suffer seriously when dealing with the factual reality of climate change and evolution.

One of the clearest-cut ways that wealthy people avoid paying taxes is by routing their money in complicated ways through corporate entities, especially via so-called "sub-S" corporations. By taking a small direct salary and then paying yourself through your S corporation, one can avoid paying both income and payroll taxes. The IRS has been cracking down more on this, but they cannot litigate each individual case, and so the wealthy reap enormous benefits from playing the highly favorable odds.

Consider the “Roadmap for America’s future” released by Paul Ryan, the ranking Republican on the House budget committee, and embraced by Mitt Romney. The CBPP finds that it will explode deficits and raise taxes on the middle/lower class. The hilarious thing is that I grew up always being told that Democrats just run up deficits while Republicans really safeguard the treasury of the Republic...yep, the GOP sure does know economics.

Of course Republicans cannot and will not admit that they just don't want their bankrollers to have to pay a little more in income taxes. So instead they hide behind "small business" and the supply side voodoo that used to be all the rage...in the 80s.

As Steve Benen summarizes:

"Thirty years ago, this raving stupidity had a name: "voodoo economics." More recently, it's come to be known as belief in the "Tax Fairy."Bingo.

Regardless of the name, the notion that tax cuts necessarily pay for themselves is one of the more pernicious lies in the far-right arsenal. It's both gibberish and right-wing propaganda, but it's nevertheless repeated from time to time.

It shouldn't be -- the concept has been debunked repeatedly by those who care about reality. How wrong is the argument? The Bush/Cheney Office of Management and Budget and the Bush/Cheney Council of Economic Advisers rejected the notion that tax cuts can pay for themselves out of hand. Fiorina, in other words, is promising to be even more fiscally irresponsible than the bunch that added $5 trillion to our national debt in eight years.

Even a fired CEO should be able to understand the reality here. The single biggest cause of the current deficit is Bush's tax cuts. They didn't "pay for themselves"; they put us in a devastating hole."

And remember this as the "fiscal cliff" approaches: the Bush tax cuts were fiscally irresponsible giveaways to the wealthy. Republicans do not want them to expire on the rich. Republicans do not want to admit that they explode our deficit and debt. Republicans will consider it a major concession if the Democrats allow them to expire for the rich and will try to use that as leverage to get money out of the hands of poor and old people via Medicaid/Medicare/Social Security cuts. Somehow, some way, people actually vote for these clowns?

But Republicans don't just suffer from a lack of reality with respect to economics. They also suffer seriously when dealing with the factual reality of climate change and evolution.

Sunday, July 1, 2012

Info post

I must have been putting this information together for some blog post, which has now escaped my memory and died due to neglect...but I hate to trash the info, since I may some day remember why I posted it.

Sunday, April 15, 2012

Krugman and Wells on Inequality

Economy killers: Inequality and GOP ignorance

By failing Econ 101, Republican leaders failed the country and repeated the errors that caused the Great Depression

By Paul Krugman and Robin Wells

Sunday, Apr 15, 2012

America emerged from the Great Depression and the Second World War with a much more equal distribution of income than it had in the 1920s; our society became middle-class in a way it hadn’t been before. This new, more equal society persisted for 30 years. But then we began pulling apart, with huge income gains for those with already high incomes. As the Congressional Budget Office has documented, the 1 percent — the group implicitly singled out in the slogan “We are the 99 percent” — saw its real income nearly quadruple between 1979 and 2007, dwarfing the very modest gains of ordinary Americans. Other evidence shows that within the 1 percent, the richest 0.1 percent and the richest 0.01 percent saw even larger gains.

By failing Econ 101, Republican leaders failed the country and repeated the errors that caused the Great Depression

By Paul Krugman and Robin Wells

Sunday, Apr 15, 2012

America emerged from the Great Depression and the Second World War with a much more equal distribution of income than it had in the 1920s; our society became middle-class in a way it hadn’t been before. This new, more equal society persisted for 30 years. But then we began pulling apart, with huge income gains for those with already high incomes. As the Congressional Budget Office has documented, the 1 percent — the group implicitly singled out in the slogan “We are the 99 percent” — saw its real income nearly quadruple between 1979 and 2007, dwarfing the very modest gains of ordinary Americans. Other evidence shows that within the 1 percent, the richest 0.1 percent and the richest 0.01 percent saw even larger gains.

Sunday, April 3, 2011

Georgia on my mind

Jay Bookman updates us on the fate of a de facto state income "flat tax" proposed by Republicans. As all thinking people already know, the "flat tax" is horribly regressive. It always, always means a raise in taxes for the vast majority of us, while lowering them significantly for the wealthy. Here's a chart put together by the Fiscal Research Center at GSU:

Now before you go and feel sorry for the wealthy, thinking they deserve a 20% break on their taxes, here's a chart showing the federal marginal tax rates for the top earners:

So basically rich people are already paying a significantly lower federal income tax rate than any time since the Great Depression. There is a strong inverse relationship between their tax rates and income inequality. The only person who should want a "flat tax" -- aka the Orwellian "fair tax" -- are those people making a hell of a lot more than 95% of us, who want even more by taking it from us.

So basically rich people are already paying a significantly lower federal income tax rate than any time since the Great Depression. There is a strong inverse relationship between their tax rates and income inequality. The only person who should want a "flat tax" -- aka the Orwellian "fair tax" -- are those people making a hell of a lot more than 95% of us, who want even more by taking it from us.

Now before you go and feel sorry for the wealthy, thinking they deserve a 20% break on their taxes, here's a chart showing the federal marginal tax rates for the top earners:

So basically rich people are already paying a significantly lower federal income tax rate than any time since the Great Depression. There is a strong inverse relationship between their tax rates and income inequality. The only person who should want a "flat tax" -- aka the Orwellian "fair tax" -- are those people making a hell of a lot more than 95% of us, who want even more by taking it from us.

So basically rich people are already paying a significantly lower federal income tax rate than any time since the Great Depression. There is a strong inverse relationship between their tax rates and income inequality. The only person who should want a "flat tax" -- aka the Orwellian "fair tax" -- are those people making a hell of a lot more than 95% of us, who want even more by taking it from us.

Sunday, March 20, 2011

Economics and Politics

My initial political leanings, if you can call it that, came from a childhood steeped in conservatism. I remember clearly hearing talk about "welfare queens" bankrupting the country and how union workers were lazy and were a real drag on corporate growth and profits. My parents were big fans of Reagan and thought that taxes were basically always wasted on someone who didn't deserve them. I read Ayn Rand's "Atlas Shrugged" when I was about 22 and went through a libertarian phase which I now see as hopelessly naive. For the libertarian and hard-core right-wingers, personal property is sacrosanct: taxes are an immoral theft of the government, a "transfer of wealth" from the rightful owner to some undeserving social parasite.

Wednesday, December 1, 2010

Smoking and Health Care Costs

We all know that tobacco kills people. It destroys their heart health and ravages the body with cancer. These are not debatable facts. Yet tobacco remains fairly popular, with a median usage rate of 18.1% among adults (CDC data below). That's even more popular than Shards O' Glass!

According to a recent study in Ohio:

The CDC released updated figures on state-by-state smoking rates and smokeless tobacco usage rates:

Unsurprisingly to me, Kentucky and West Virginia topped the list of smokers, at 25.6%. From my own anecdotal experience, I have noticed how high the rates are in eastern KY and southern WV (as well as southwestern VA). Over one in four adults smoke there. In addition, 6.7% and 8.5% of adults there use smokeless tobacco, respectively. That means that over 30% of Kentuckians and West Virginians are regular tobacco users. How many billions of dollars in health care costs could those states save by raising taxes on tobacco products?

And it may be even worse than that:

I looked up the tax rates on tobacco there and the taxes there (KY and WV) are well below the national average, although still lower than in neighboring Virginia:

So at the end of the day, the states with the highest usage of tobacco have some of the lowest tax rates. This despite the fact that it has been known for some time that the costs of smoking are largely borne by society (non-smokers) via higher health costs. While states are scrambling to lay off teachers and police in order to balance their budgets, perhaps the first order of business would be to cut spending on health care, raise revenues and increase people's quality of life with one simple action: raise tobacco taxes.

According to a recent study in Ohio:

Each 1 percent decline in smoking rates would save the state $838 million in health care costs, including $148.5 million in state Medicaid costsLet that really sink in for a minute -- we could save literally billions and billions of dollars in health care costs annually by reducing the number of smokers nationally by a few percentage points. What's the most reliable way to reduce smoking rates? Raise taxes on them.

The CDC released updated figures on state-by-state smoking rates and smokeless tobacco usage rates:

Unsurprisingly to me, Kentucky and West Virginia topped the list of smokers, at 25.6%. From my own anecdotal experience, I have noticed how high the rates are in eastern KY and southern WV (as well as southwestern VA). Over one in four adults smoke there. In addition, 6.7% and 8.5% of adults there use smokeless tobacco, respectively. That means that over 30% of Kentuckians and West Virginians are regular tobacco users. How many billions of dollars in health care costs could those states save by raising taxes on tobacco products?

And it may be even worse than that:

The findings in this report are subject to at least three limitations. First, BRFSS does not include adults without telephone service (1.7%) or with wireless-only service (24.5%), and adults with wireless-only service are twice as likely to smoke cigarettes as the rest of the U.S. population (9). Because wireless-only service varies by state (9), these data likely underestimate the actual prevalence of cigarette smoking in some states and might underestimate smokeless tobacco use.So basically it could be as high as 40% in those states...

I looked up the tax rates on tobacco there and the taxes there (KY and WV) are well below the national average, although still lower than in neighboring Virginia:

So at the end of the day, the states with the highest usage of tobacco have some of the lowest tax rates. This despite the fact that it has been known for some time that the costs of smoking are largely borne by society (non-smokers) via higher health costs. While states are scrambling to lay off teachers and police in order to balance their budgets, perhaps the first order of business would be to cut spending on health care, raise revenues and increase people's quality of life with one simple action: raise tobacco taxes.

Thursday, November 11, 2010

More light, less heat

That's sort of a theme around my workplace. We do light-emitting diodes and want more luminous power and lower resistivity (losing energy to heat). But it applies just as well to discussions of policy.

It's crossing my mind -- now that the midterm elections are over -- to wonder what will really happen given the Republicans larger role in governing, as well as the possibility that they may take the Senate and/or the presidency in 2012. How will they govern? Assuming continuing gains for the GOP in 2012, the composition of the House and Senate still will not likely be very different than 2004 (including the fact that many of the members of Congress will be the same exact people), ergo compromising will be a necessity, right?

How will we fix the crushing budget deficits, whose causes are well-established? If you don't already realize this, the major pieces of the federal budget are: (FY 2010)

1) medicare/medicaid (20.90%)

2) social security (19.63%)

3) dept of defense (18.74%)

= ~60%

The President's budget for 2010 has total spending of the gov't at $3.55 trillion. Our budget deficit for 2010 is $1.2 trillion, or almost 1/3 of that amount.

So basically 3/5 of our entire federal budget goes to these three things (not counting special appropriations for the wars). If politicians aren't serious about cutting these three programs in careful, smart, but serious ways, then we literally cannot balance our budget.

The the long-awaited deficit reduction commission's draft report will send recommendations to the President that include extending the age of retirement and means-testing to save Social Security, overhauling and simplifying the tax code while lowering rates for the wealthy, and some other interesting items. They couldn't get enough agreement on the proposals to make it a final report, because 14 out of 18 members couldn't agree on this. Paul Krugman thinks that lowering income taxes even further on billionaires is a ridiculous way to balance the budget. I'm not expert enough to analyze the merits of these recommendations on the economics. What I do know, however, is that Social Security has always been the "third rail" in politics -- touch it and you're dead.

Introducing the proposed changes into Social Security that will basically give the shaft to lower-income people, regardless of the fiscal merits, is simply not going to happen. It is a political non-starter. And, surprisingly to some of my conservative friends, this is *even more* true of Republicans than Democrats. Listen to SC Republican Senator Jim DeMint -- one of the most right-wing of all Republicans, if not *the* most right-wing -- commenting on Meet the Press about the concept of overhauling Social Security:

When Republicans passed the Medicare drug benefit (Part D) of 2003, they lied about its costs and just pretended it didn't have to be paid for. Pop quiz: which costs more -- the GOP's Part D or the Dems' health care reform?

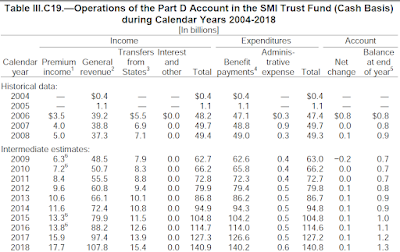

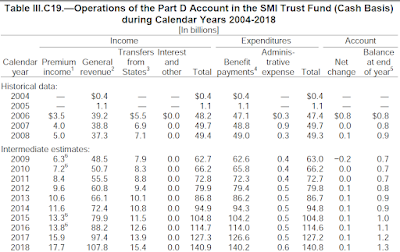

Ans: Part D. Part D is estimated to cost $951 billion over the decade 2009-2018. (See Table III.C.19, page 120, shown below) In addition, the cost of that plan only grows with time as our aging population increases. Almost every penny of that is pure deficit spending.

Republicans wrote the bill so that big pharma companies get far more money from Medicare Part D for the exact same drugs than the Dept of Veterans Affairs pays for them. In the House, only 25 Republicans voted against the budget-busting bill while all but 16 Democrats voted no. The main player in writing the legislation in the House left his job and took a $2 million a year lobbying job with...a pharmaceutical company...(all facts that have been documented pretty easily by lots of principled people)

What about the other major political party and their health care reform bill (ACA)?

The Dems' plan requires $382 billion of spending total over the period 2010 - 2019 to expand insurance coverage and close the Part D "donut hole". (See Table 2, page 18 of the PDF, shown below)

These costs are financed in part by cutting wasteful spending to private insurers for Medicare "Advantage" plans and raising Medicare premiums on those making over $250,000 a year. Those revenues combine to give back the government $525 billion during that same period, thus *lowering* the deficit by $140 billion! On top of that, in the next decade, it is estimated to save far more!

When Dems passed the Affordable Care Act they used CBO scoring and raised some Medicare taxes on the rich to pay for the costs associated with expanding coverage. They pushed to allow drug prices to be negotiated. The bill lowers the deficit by over a hundred billion dollars in the first decade.

In short, if you believe that Democrats are the party who spends too much, or adds more to the deficit, you're simply living in a fantasy world. Facts are hard, cold and stubborn things.

Ed Brayton has an interesting view on this. He thinks that Republicans are able to get away with this bullshit for strategic reasons:

Tom Toles is spot on:

It's crossing my mind -- now that the midterm elections are over -- to wonder what will really happen given the Republicans larger role in governing, as well as the possibility that they may take the Senate and/or the presidency in 2012. How will they govern? Assuming continuing gains for the GOP in 2012, the composition of the House and Senate still will not likely be very different than 2004 (including the fact that many of the members of Congress will be the same exact people), ergo compromising will be a necessity, right?

How will we fix the crushing budget deficits, whose causes are well-established? If you don't already realize this, the major pieces of the federal budget are: (FY 2010)

1) medicare/medicaid (20.90%)

2) social security (19.63%)

3) dept of defense (18.74%)

= ~60%

The President's budget for 2010 has total spending of the gov't at $3.55 trillion. Our budget deficit for 2010 is $1.2 trillion, or almost 1/3 of that amount.

So basically 3/5 of our entire federal budget goes to these three things (not counting special appropriations for the wars). If politicians aren't serious about cutting these three programs in careful, smart, but serious ways, then we literally cannot balance our budget.

The the long-awaited deficit reduction commission's draft report will send recommendations to the President that include extending the age of retirement and means-testing to save Social Security, overhauling and simplifying the tax code while lowering rates for the wealthy, and some other interesting items. They couldn't get enough agreement on the proposals to make it a final report, because 14 out of 18 members couldn't agree on this. Paul Krugman thinks that lowering income taxes even further on billionaires is a ridiculous way to balance the budget. I'm not expert enough to analyze the merits of these recommendations on the economics. What I do know, however, is that Social Security has always been the "third rail" in politics -- touch it and you're dead.

Introducing the proposed changes into Social Security that will basically give the shaft to lower-income people, regardless of the fiscal merits, is simply not going to happen. It is a political non-starter. And, surprisingly to some of my conservative friends, this is *even more* true of Republicans than Democrats. Listen to SC Republican Senator Jim DeMint -- one of the most right-wing of all Republicans, if not *the* most right-wing -- commenting on Meet the Press about the concept of overhauling Social Security:

GREGORY: I want to be very specific, because going back to 2008 spending levels will not get anywhere close to balancing the budget. So, you're saying that everything has to be on the table. Cuts in defense. Cuts in Medicare. Cuts in Social Security. Is that right?Mark my words: while people may loathe Democrats and accuse them of having a "tax and spend" mentality, Republicans will be bigger spenders,just as they always have been, but without the honesty of even trying to balance the budget, just as they always have been. Compare the two parties' approaches to health care:

DEMINT: Well, no, we're not talking about cuts in Social Security. If we can just cut the administrative waste, we can cut hundreds of billions of dollars a year at the federal level. So, before we start cutting -- I mean, we need to keep our promises to seniors, David. And cutting benefits to seniors is not on the table.

GREGORY: But then, but where do you make the cuts? I mean, if you're protecting everything for the most potent political groups, like seniors, who go out and vote, where are you really gonna balance the budget?

DEMINT: Well, look at Paul Ryan's roadmap to the future. We see a clear path to moving back to a balanced budget over time. Again, the plans are on the table. We don't have to cut benefits for seniors. And we don't need to cut Medicare -- like the Democrats did in this big Obamacare bill. We can restore sanity in Washington without cutting any benefits to seniors or veterans.

When Republicans passed the Medicare drug benefit (Part D) of 2003, they lied about its costs and just pretended it didn't have to be paid for. Pop quiz: which costs more -- the GOP's Part D or the Dems' health care reform?

Ans: Part D. Part D is estimated to cost $951 billion over the decade 2009-2018. (See Table III.C.19, page 120, shown below) In addition, the cost of that plan only grows with time as our aging population increases. Almost every penny of that is pure deficit spending.

Republicans wrote the bill so that big pharma companies get far more money from Medicare Part D for the exact same drugs than the Dept of Veterans Affairs pays for them. In the House, only 25 Republicans voted against the budget-busting bill while all but 16 Democrats voted no. The main player in writing the legislation in the House left his job and took a $2 million a year lobbying job with...a pharmaceutical company...(all facts that have been documented pretty easily by lots of principled people)

What about the other major political party and their health care reform bill (ACA)?

The Dems' plan requires $382 billion of spending total over the period 2010 - 2019 to expand insurance coverage and close the Part D "donut hole". (See Table 2, page 18 of the PDF, shown below)

These costs are financed in part by cutting wasteful spending to private insurers for Medicare "Advantage" plans and raising Medicare premiums on those making over $250,000 a year. Those revenues combine to give back the government $525 billion during that same period, thus *lowering* the deficit by $140 billion! On top of that, in the next decade, it is estimated to save far more!

When Dems passed the Affordable Care Act they used CBO scoring and raised some Medicare taxes on the rich to pay for the costs associated with expanding coverage. They pushed to allow drug prices to be negotiated. The bill lowers the deficit by over a hundred billion dollars in the first decade.

In short, if you believe that Democrats are the party who spends too much, or adds more to the deficit, you're simply living in a fantasy world. Facts are hard, cold and stubborn things.

Ed Brayton has an interesting view on this. He thinks that Republicans are able to get away with this bullshit for strategic reasons:

For all the Republican rhetoric about smaller government and "tax and spend liberals," the fact is that over the past 50 years the size of government has grown more under Republican presidents than under Democratic ones -- and so has the size of the debt because of their reluctance to raise taxes.Perhaps...

From 1962-2001, the average growth in total federal spending under Republican presidents has been 7.57%; under Democrats, 6.96%. Bush certainly did not help those averages any after 2001. During that same period, the average yearly deficit under Democrats was $36 billion; the average under Republicans was $190 billion. So under Republicans, spending grows more but revenues grow less because they always insist on tax cuts.

And that means taxes must go up at some point to pay the cost of the deficit spending plus the interest on that borrowing. I think part of the GOP strategy for the past 50 years (40 at least) has been to drive up the deficit intentionally by raising spending and cutting taxes, knowing that when the Democrats are in control they will have to raise taxes. Then they can say, "See, the Democrats are always raising your taxes!" -- but without acknowledging that it was made necessary by their own borrow and spend policies.

The fact is that neither party has any interest in actually reducing spending. The difference is that the Democrats are generally more willing to pay for it with taxes while the Republicans refuse to do so. And I think that is a deliberate strategy on their part.

Tom Toles is spot on:

Thursday, October 28, 2010

We're number one!

The National Academy released a new review of its 2005 recommendations (here) for how the US can maintain or increase its standing in an array of global measures of productivity and success (free PDF here). As you might imagine, the title of this post is satirical.

Subscribe to:

Posts (Atom)